Are Vacation Rentals Good Investments?

are vacation rentals good investments?

Is Investing in Vacation Rentals a Good Investment?

If you’re considering where to put your money, you’ve likely wondered whether investing in vacation rentals is a good move. The short answer is yes—vacation rentals can be incredibly profitable, offering both immediate income and long-term gains.

The rise of platforms like Airbnb and Vrbo has opened up opportunities for everyday investors to turn properties into lucrative income streams. But the appeal doesn’t stop at financial returns; owning a vacation rental also allows you to enjoy your investment personally, using the property during off-peak times.

That said, like any investment, vacation rentals come with their own set of risks and considerations. The market is dynamic, influenced by factors such as location, seasonality, and economic trends.

To truly understand whether vacation rentals are a good fit for your investment strategy, it’s essential to weigh the potential financial benefits against the operational challenges and market fluctuations.

The Importance of Market Analysis for Profitable Vacation Rentals

A market analysis is crucial to determining the profitability of a vacation rental because it provides insights into key factors such as supply and demand, competitive pricing, and occupancy rates. By examining local trends, seasonal fluctuations, and the presence of comparable properties, investors can identify the most profitable locations, ideal pricing strategies, and potential risks. This data-driven approach helps to avoid over-investing in areas with low demand or over-saturated markets, ensuring that the rental remains a viable and profitable asset. Learn how to do an Airbnb and vacation rental market analysis >

Financial Benefits of Vacation Rental Investments

High Income Potential from Vacation Rentals

One of the most compelling arguments for investing in vacation rentals is the potential for high income. Vacation rentals typically command higher nightly rates than traditional long-term rentals, particularly in popular tourist destinations.

This can translate into significant revenue during peak seasons, making it an attractive option for those looking to generate substantial cash flow.

Dynamic pricing plays a crucial role in maximizing this income. By adjusting rental rates based on factors like seasonality, local events, and competition, owners can optimize their revenue. For instance, rates can be increased during high-demand periods like holidays or local festivals and adjusted downward during slower times to maintain steady bookings.

Listing your property on multiple platforms, such as Airbnb, Vrbo, and Booking.com, can further enhance occupancy rates and income potential.

However, it’s important to recognize that income levels can vary based on location and market conditions. While the average monthly income for Airbnb hosts in the U.S. is around $924, properties in prime locations can earn much more

(Bitton).

In 2023, the average daily rate for short-term rentals was just over $300, reflecting the strong revenue potential in this market (Henderson). These figures suggest that with the right strategy, vacation rentals can indeed be a lucrative investment, though success depends on careful management and market understanding.

Property Appreciation and Long-Term Gains

In addition to providing a steady income stream, vacation rentals offer the potential for long-term financial gains through property appreciation. Real estate, in general, is known for its ability to appreciate over time, and vacation rentals are no exception.

When you invest in a property in a high-demand area, you’re not just securing an income source—you’re also acquiring an asset that is likely to increase in value over time.

Location is a key factor in this appreciation. Properties in desirable tourist destinations or growing economic regions tend to appreciate more quickly. Furthermore, making strategic upgrades to your property—such as modernizing the kitchen or adding a hot tub—can make it more attractive to renters and increase its market value.

These improvements not only boost your rental income but also enhance the property's long-term appreciation.

However, it’s worth noting that property appreciation can be influenced by broader economic trends. During economic downturns, vacation rentals in domestic leisure destinations have historically performed well, as travelers often seek more affordable, close-to-home vacation options.

This resilience adds a layer of security to vacation rental investments, making them a potentially wise choice even during uncertain times (Bitton).

Tax Advantages for Vacation Rental Investors

Tax benefits are another compelling reason to consider investing in vacation rentals. The IRS treats vacation rentals as business properties, which means owners can deduct a wide range of expenses associated with operating and maintaining the property.

These deductions can include mortgage interest, property taxes, insurance premiums, utilities, and even repair costs (Rohde).

One of the most significant tax advantages available to vacation rental owners is depreciation. Depreciation allows you to spread the cost of the property and any significant improvements over several years, reducing your taxable income without affecting cash flow.

For residential properties, the typical recovery period is 27.5 years, but items like appliances and furnishings can often be depreciated over a shorter period, providing quicker tax relief (Rohde).

However, it’s important to be aware of the IRS’s 14-day or 10% rule, which dictates how much of your property’s expenses can be deducted. According to the IRS, if you rent out your property for 14 days or less in a year, you don’t have to report the rental income, but you also can’t deduct any rental expenses (Rohde).

If the property is rented out for more than 14 days and personal use does not exceed 10% of the total rental days, it’s considered a rental for tax purposes, allowing you to deduct a proportionate amount of your expenses and reduce your taxable income.

These tax advantages can significantly enhance the overall profitability of vacation rentals, making them an attractive option for investors looking to maximize their returns. However, like any investment, success depends on careful planning and a thorough understanding of the financial landscape.

To learn more about taxes and vacation rentals, read our article, "Taxes on Vacation Rental Income."

Personal Enjoyment and Lifestyle

Vacation Property for Personal Use

One of the most appealing aspects of investing in a vacation rental is the ability to use the property yourself. Imagine having a dedicated place to escape to, whether it’s a beach house, a mountain cabin, or a city apartment. Owning a vacation rental allows you to enjoy the property for personal vacations, offering a home-away-from-home experience without the ongoing costs of booking accommodations. This can be particularly valuable during peak travel seasons when accommodation prices skyrocket.

However, it’s important to be aware of IRS rules regarding personal use. According to the IRS, "if you use the property for personal purposes for more than 14 days per year or more than 10% of the total days it’s rented out, the property is considered a personal residence rather than a rental property." This classification can limit the rental expenses you can deduct on your taxes (IRS). The IRS also notes that "you won't be able to deduct your rental expense in excess of the gross rental income limitation" in such cases (IRS).

Retirement Planning

Vacation rentals can also serve as a long-term strategy for retirement planning. Some investors purchase these properties with the intention of using them as retirement homes in the future. In the meantime, the rental income can help pay off the mortgage, making it easier to own the property outright by the time you retire. Once retired, you have a fully paid-for vacation home in a location you love, where you can spend extended periods without worrying about rental costs.

This strategy not only provides a future retirement home but also helps build equity in a property that can appreciate over time.

Diversification of Investment Portfolio

Asset Diversification

Investing in vacation rentals offers a way to diversify your investment portfolio beyond traditional stocks, bonds, and long-term rental properties. Real estate, particularly in desirable vacation destinations, tends to hold its value over time and can serve as a hedge against inflation. Owning a vacation rental adds a tangible asset to your portfolio, which can provide stability, especially in uncertain economic times.

As a physical asset, real estate often behaves differently from financial markets, offering a different kind of security. This diversification can help balance your overall investment risk, making your financial portfolio more resilient to market fluctuations.

Property Appreciation

Long-Term Value Increase

While rental income is a significant advantage, the potential for property appreciation is another compelling reason to invest in vacation rentals. Real estate is generally a stable investment, with property values tending to increase over time. Vacation rentals, especially those located in high-demand tourist areas, are no exception. By investing in such properties, you’re not just securing an income stream; you’re also acquiring an asset that is likely to appreciate in value.

Property improvements can further enhance this appreciation. Upgrading kitchens, bathrooms, or adding amenities like hot tubs can make your property more attractive to renters and increase its market value. These enhancements not only boost rental income but also contribute to the property’s long-term appreciation, making it a valuable asset for the future.

Tax Benefits Beyond Income

Tax Deductions

Investing in vacation rentals comes with a variety of tax benefits that extend beyond just rental income. The IRS allows you to deduct a range of expenses associated with maintaining and operating the property, such as mortgage interest, property taxes, utilities, insurance, and depreciation (IRS).

Depreciation, in particular, is a powerful tool for vacation rental investors. It allows you to deduct the cost of buying and improving your rental property over its useful life, which the IRS considers to be 27.5 years for residential properties (Folger). Typically, properties are depreciated at a rate of 3.636% annually under the Modified Accelerated Cost Recovery System (MACRS).

Depreciation begins as soon as the property is placed in service—meaning it’s ready to be rented out—even if a tenant has not yet moved in. For instance, if your property is ready for rental on July 15, you start depreciating from that date, regardless of when you actually begin collecting rent (Folger). This allows you to spread out the cost of the property and significant improvements over time, reducing your taxable income each year and improving cash flow.

However, if you use the property for both personal and rental purposes, you must divide your expenses accordingly. The IRS requires you to allocate expenses based on the number of days the property is used for each purpose, which can limit the amount you can deduct (IRS). Additionally, it’s important to remember that while depreciation offers immediate tax benefits, you may be subject to depreciation recapture tax if you sell the property for more than its depreciated value (Folger).

Understanding these tax benefits and limitations is crucial for maximizing the financial advantages of owning a vacation rental.

Potential Risks and Challenges in Vacation Rental Investments

Upfront Costs of Buying a Vacation Rental Property

Buying a vacation home comes with significant upfront costs. These expenses can be a considerable financial outlay, requiring careful planning and budgeting.

Initial Financial Outlay

The first major cost is the down payment, which is typically higher for investment properties than for primary residences. While down payments for primary homes can be as low as 3% to 5%, lenders often require 20% to 30% for investment properties to offset the higher risk.

Additionally, if the property needs renovations or upgrades to meet guest expectations, these costs can quickly add up.

Renovations and Furnishing Costs

Renovating a vacation rental to make it appealing to guests might include updating kitchens, bathrooms, and outdoor spaces. Beyond renovations, furnishing the property with comfortable, durable furniture and amenities is crucial.

High-quality furnishings not only enhance guest experiences but also reduce wear and tear over time. This could mean investing in everything from beds and sofas to kitchenware and entertainment options.

Mortgage Rates and Financial Planning

Mortgage rates for investment properties are typically higher than those for primary residences. It's essential to shop around for the best rates and consider how the mortgage will fit into your overall financial plan.

Investors should also factor in other expenses such as property taxes, insurance, and possibly private mortgage insurance (PMI), depending on the down payment. Financial planning for a vacation rental investment should include a thorough analysis of all these costs to ensure the investment is viable.

Maintenance and Upkeep of Vacation Homes

Ongoing maintenance and upkeep are crucial aspects of managing a vacation rental. Due to frequent guest turnover, vacation rentals often require more attention than long-term rental properties.

High Guest Turnover

The constant flow of guests can lead to increased wear and tear on the property. This means more frequent repairs, replacements, and deep cleaning between stays. Regular maintenance tasks might include servicing HVAC systems, checking for plumbing leaks, and maintaining outdoor spaces.

Seasonal maintenance, such as winterizing the property or preparing it for summer, is also essential to keep the home in top condition year-round.

Professional Property Management

For investors who live far from their vacation rental or who prefer a hands-off approach, hiring a professional property management company can be a wise decision. These companies handle everything from routine maintenance and guest communications to emergency repairs, ensuring the property is always ready for the next guest.

While this service comes at a cost—typically 20% to 30% of rental income—it can alleviate much of the stress associated with managing a vacation rental.

Learn more about the best short-term rental management companies here.

Managing Seasonality and Fluctuations in Rental Demand

Seasonality is a significant factor in the vacation rental market. Depending on the location, demand for rentals can vary widely throughout the year, impacting occupancy rates and income.

Impact of Seasonal Demand

In many vacation destinations, peak seasons (such as summer or winter holidays) bring high occupancy rates and premium rental prices. However, the off-season can result in lower demand, reduced rental rates, and vacancies. This fluctuation can make it challenging to maintain a steady income stream throughout the year.

Strategies to Mitigate Low-Season Challenges

To counteract the effects of seasonality, vacation rental owners can employ several strategies. Dynamic pricing—adjusting rates based on demand, competition, and other factors—can help maximize occupancy during slower periods.

Offering discounts or promotions during the off-season can also attract guests who are looking for deals. Additionally, focusing on niche markets, such as long-term stays or remote workers, can help fill gaps during periods of low demand.

Navigating Legal and Regulatory Issues in Vacation Rental Investments

Legal and regulatory challenges are among the most complex aspects of managing a vacation rental property. These issues are established at the municipal, county, or city level and can vary significantly depending on the location of the property.

Local Regulations and Legal Challenges

Many popular vacation destinations have specific laws governing short-term rentals. These can include zoning restrictions, occupancy limits, and requirements for permits or licenses.

"Zoning rules set out the way you can use your property/home," and in some cases, they may prevent the use of a property as a vacation rental altogether (Zeevou). Other regulations may address issues such as noise and nuisance, ensuring that vacation rentals do not disrupt local communities. For instance, some areas impose occupancy limits to ensure guest safety and prevent overcrowding (Zeevou).

Importance of Compliance

Staying compliant with local regulations is crucial for maintaining profitability and avoiding legal issues. "You may need to pay tax for each overnight stay," and in some locations, platforms like Airbnb collect these taxes on behalf of hosts (Zeevou).

This means keeping up-to-date with any changes in local laws and ensuring that your property meets all required standards. It may also involve collecting and remitting local taxes, such as occupancy or tourism taxes, which can add another layer of complexity.

Working with a local real estate attorney or a professional property management company that is familiar with local laws can help navigate these challenges.

Market Growth and Trends in Vacation Rental Investments

The Growing Appeal of Vacation Rentals Among Millennials

The vacation rental market has seen significant growth in recent years. This growth is largely driven by shifting traveler preferences, especially among millennials. As the largest demographic group in the travel industry, millennials are changing how vacation rentals operate with their unique preferences and travel behaviors.

Insights into the Demographics Driving the Market:

Millennials, born between 1981 and 1996, are now entering their prime spending years. This generation values experiences over material goods, making vacation rentals an ideal choice. Unlike older generations who preferred hotels, millennials are drawn to the personalized and authentic experiences vacation rentals offer.

They seek unique accommodations that immerse them in local cultures. Whether it’s a rustic cabin, a chic city apartment, or a beachfront villa, millennials prefer to "live like a local." This preference is a key factor driving the growth of the vacation rental market.

Impact of Changing Traveler Preferences

The rise of remote work has further fueled the demand for vacation rentals. Millennials, who are more likely to work remotely, often choose vacation rentals that double as temporary home offices. Properties with high-speed internet, dedicated workspaces, and proximity to nature or urban centers are in high demand.

Millennials also tend to travel in groups, with friends or family. This makes vacation rentals with multiple bedrooms and communal spaces more appealing. In contrast, traditional hotels may require booking multiple rooms, which can be more expensive.

The growing appeal of vacation rentals among millennials isn’t just a trend. It reflects a broader change in how people view travel and accommodations. Millennials’ influence is expected to drive demand in the vacation rental market for years to come.

Global Market Growth for Vacation Rental Properties

The global vacation rental market is set for continued growth. This growth is driven by increasing demand from diverse demographics, technological advancements, and shifting travel patterns. The market’s expansion offers significant opportunities for investors who are ready to capitalize on these trends.

Expected Trends in Occupancy Rates, Rental Rates, and Market Expansion

As the market grows, we can expect continued increases in occupancy rates and rental rates. The market has rebounded strongly from COVID-19, with occupancy rates stabilizing and increasing in many regions.

For instance, the global occupancy rate for vacation rentals is expected to hover around 57.4% in 2024. This reflects a healthy recovery and ongoing demand (Henderson).

Rental rates are also expected to rise. This is driven by inflation and the increased costs of maintaining vacation rental properties. Dynamic pricing strategies, which adjust rental rates based on demand, seasonality, and local conditions, are becoming more common. These strategies help property owners maximize their revenue.

Certain regions are expected to see strong growth. Europe continues to hold the largest market share, with contributions from popular destinations like Spain, Italy, and France. Emerging markets in Asia-Pacific, particularly Australia and China, are also expected to grow rapidly. Australia is projected to have a CAGR of 6.6% from 2023 to 2030 (Bitton).

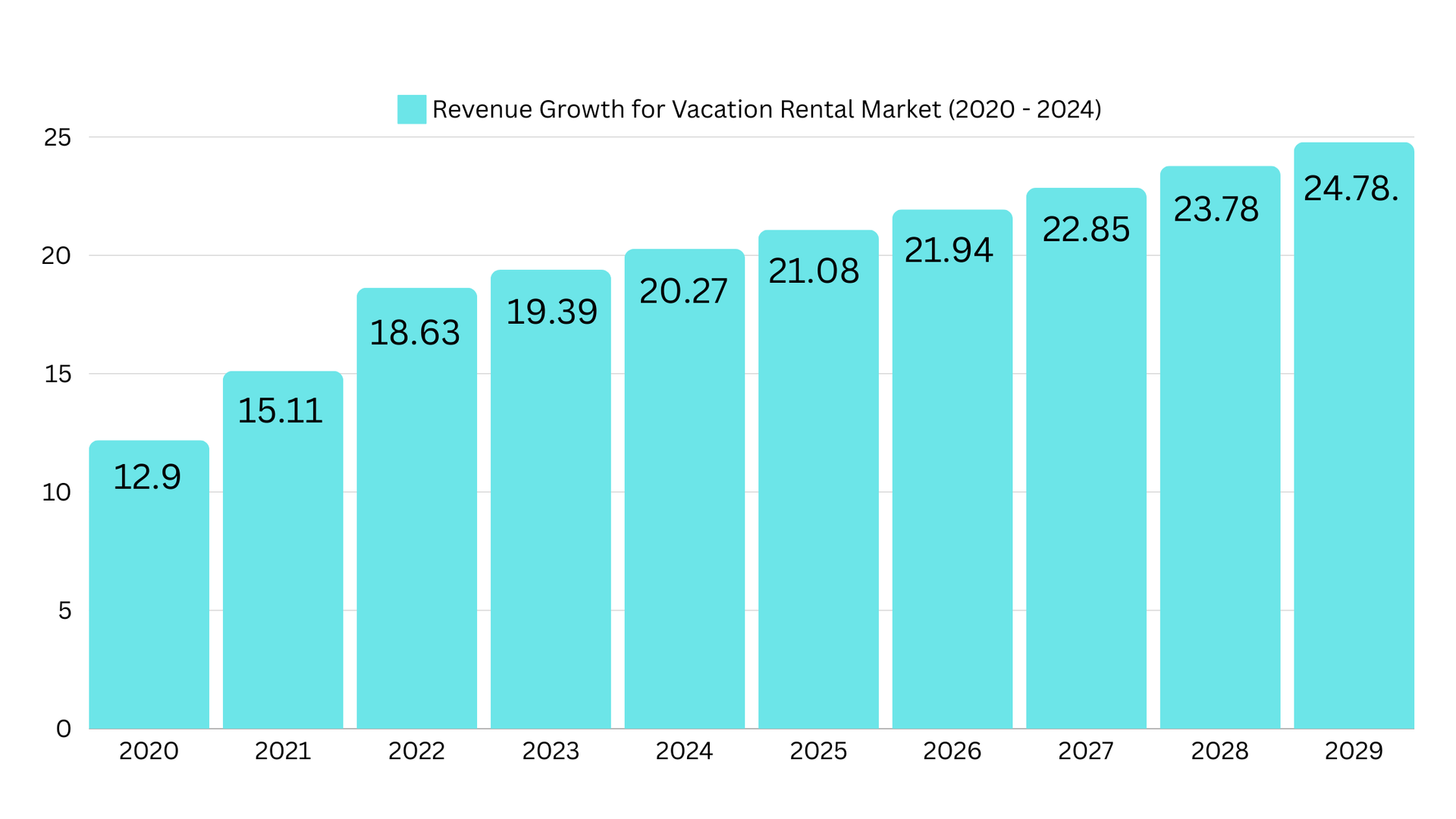

The U.S. market is also set to expand, with a projected market volume of $24.78 billion by 2029 (Statista). This global expansion presents lucrative opportunities for investors. By staying informed about market trends and adapting to changing preferences, investors can take advantage of the continued growth in this dynamic sector.

More notable statistics

- 4.7% - Expected compound annual growth rate (CAGR) from 2023 to 2030 (Bitton).

- $119.01 billion - Projected global market value by 2030 (Bitton).

- $20.27 billion - Projected revenue for the U.S. market in 2024 (Statista).

- 85% - Percentage of U.S. revenue expected to be generated online by 2029 (Statista).

- 71.94 million - Expected number of U.S. users by 2029 (Statista).

- $316.50 - Expected average revenue per user (ARPU) in the U.S. market in 2024 (Statista).

- 57.4% - Projected global occupancy rate in 2024 (Henderson).

- 6.6% - Expected CAGR for Australia from 2023 to 2030 (Bitton).

- $24.78 billion - Projected U.S. market volume by 2029 (Statista).

Operational Considerations for Vacation Rental Investors

The Role of Technology in Vacation Rental Property Management

Technology is changing the game in vacation rental management. It offers more efficiency, better guest experiences, and higher profits for investors.

Property Management Systems and Channel Managers

Property management systems (PMS) and channel managers are leading this transformation. A PMS can automate many everyday tasks. For example, booking management, guest communication, housekeeping schedules, and financial reporting. It’s all handled seamlessly.

Channel managers help synchronize your listings across multiple platforms like Airbnb, Vrbo, and Booking.com. This keeps your availability, rates, and reservations up-to-date across all channels. The result? No double bookings and maximum exposure.

Challenges with Tech Adoption and Integrations

Adopting new technology isn’t always smooth. Some owners struggle to choose the right software. Others face issues with integrating different tools. Not all systems work well together. This can cause problems with data and workflows. To avoid these issues, do your research. Seek expert advice when needed. It can make all the difference.

The Importance of Effective Marketing for Vacation Rentals

Marketing is crucial for keeping your vacation rental booked. It’s key to your property’s success.

Continuous Marketing Efforts

\You can’t just list your property and forget about it. Continuous marketing is essential. This includes maintaining a strong online presence and making sure your property stands out. Effective marketing requires ongoing attention. Strategy matters.

Professional Photography and Compelling Listings

High-quality photos are a must. They attract guests. Good images showcase your property’s best features. A well-written listing is just as important. Highlight unique selling points, local attractions, and amenities. Make the property appealing. Simple, clear descriptions work best.

Dynamic Pricing

Dynamic pricing is a smart strategy. It means adjusting your rental rates based on factors like seasonality, local events, and demand. This helps you stay competitive. By using dynamic pricing tools, you can maximize occupancy during peak times. And still attract guests during slower periods. It’s a win-win.

The Value of Professional Property Management Services

Managing a vacation rental can be tough. It takes time and effort. That’s where professional property management services come in.

Maximizing ROI through Professional Management:

Professional management services handle everything. They take care of marketing, guest interactions, maintenance, and finances. You can focus on other things while they manage your property. It’s more efficient. And it can boost your return on investment (ROI). A well-managed property offers a better guest experience. Happy guests mean more bookings.

Partnering with Experienced Property Managers:

Choose your property manager wisely. Experience matters. An experienced manager understands the vacation rental market. They know local trends, pricing strategies, and guest preferences. They also help with regulations. Compliance is crucial. A good property manager ensures your property meets all local laws. Their expertise increases your chances of success in a competitive market.

Why Work with Us?

Comprehensive Vacation Rental Management Services

When it comes to managing vacation rentals, we offer a complete solution. Our full-service vacation rental management by Home Team Vacation Rentals covers everything—from marketing your property to handling guest communications, maintenance, and beyond. We take care of all the operational details so you don’t have to.

Our goal is simple: maximize your income while minimizing the time and effort you need to invest. With our Airbnb management and vacation rental services, you can enjoy the benefits of owning a vacation rental without the headaches of day-to-day management. We handle everything, ensuring your property is always in top condition and guests have a seamless experience.

Expertise in Real Estate Investing for Vacation Rentals

We’re not just property managers; we’re experts in real estate investing, specifically for vacation rentals. Our team has years of experience in the industry, and we’ve helped countless clients turn their properties into profitable investments.

Our track record speaks for itself.

Whether it’s a beachfront condo or a mountain cabin, we know what it takes to succeed in this market. We’ve helped clients boost their rental income, reduce vacancies, and achieve impressive returns on their investments. But don’t just take our word for it—our clients’ success stories highlight the difference we can make.

Advanced Technology and Marketing Strategies

Technology is at the heart of our approach. We use advanced tools to manage your property efficiently and ensure it performs at its best. Our dynamic pricing strategies adjust rental rates in real-time based on market demand, maximizing your income.

But that’s not all. Our marketing strategies are tailored to make your property stand out in a crowded market. From professional photography to compelling listings and targeted online campaigns, we ensure your vacation rental gets the attention it deserves. Our goal is to keep your property booked and your revenue steady.

Final Thoughts for Prospective Vacation Rental Investors

Is a Vacation Rental a Good Investment?

Vacation rentals can be a fantastic investment opportunity, offering a blend of income potential, property appreciation, and personal enjoyment. One of the major advantages of short-term rentals is the superior cash flow they can generate compared to long-term rental properties. However, they come with higher risks. Picking the wrong rental or market can significantly impact your returns, so location is key. Researching the best places to buy a vacation rental is essential to ensure your investment thrives.

Vacation rental investors also benefit from both depreciation and appreciation, making it a tax-advantaged investment. With proper planning and management, you can maximize cash flow while enjoying the long-term value growth of your property.

Why Real Estate Investing in Vacation Rentals Could Be a Great Opportunity

Vacation rentals provide a unique opportunity within the broader real estate market. They combine the tangible benefits of property ownership with the income potential of short-term rentals. As travel continues to evolve, the demand for unique, well-managed vacation rentals is likely to grow.

For those considering entering the vacation rental market, now is a great time. With the right strategy and support, your investment can offer both financial rewards and personal satisfaction. We encourage you to explore this exciting opportunity and take the first step toward a successful vacation rental investment.

Works Cited

- Folger, Jean. "How to Calculate Rental Property Depreciation." Investopedia, 10 Aug. 2024, https://www.investopedia.com/articles/investing/060815/how-rental-property-depreciation-works.asp

- Internal Revenue Service. "Topic No. 415, Renting Residential and Vacation Property." IRS.gov,https://www.irs.gov/taxtopics/tc415. Accessed 31 Aug. 2024.

- Bitton, David. "Vacation Rental Statistics: Will The Market Thrive At the End of 2024?" DoorLoop, 23 June 2024,www.doorloop.com/blog/vacation-rental-statistics.

- Henderson, Rebecca. "Short-term Rental Statistics: 2024 Report." USA Today, 11 June 2024,www.usatoday.com/money/homefront/moving/short-term-rental-statistics/.

- Rohde, Jeff. "14 Common Short-Term Rental Tax Deductions (2024 Guide)." Stessa,www.stessa.com/blog/short-term-rental-tax-deductions/. Accessed 31 Aug. 2024.

- Zeevou. "Vacation Rental Rules and Regulations: A Comprehensive Guide." Zeevou, 8 July 2023, https://zeevou.com/blog/vacation-rental-rules-and-regulations/.

- Bitton, David. "Vacation Rental Statistics: Will The Market Thrive At the End of 2024?" DoorLoop, 23 June 2024,https://www.doorloop.com/blog/vacation-rental-statistics.

- Henderson, Rebecca. "Short-term Rental Statistics: 2024 Report." USA Today, 11 June 2024,https://www.usatoday.com/money/homefront/moving/short-term-rental-statistics/.

- Statista Market Insights. "Vacation Rentals - United States." Statista, July 2024.

Categories: Investor, Property Management